Splitting the Proceeds of a 1035 Exchange Unlocks Planning Opportunities

We’ve seen strategies for utilizing accumulation-focused insurance policies that have grown significant cash value become an effective repositioning strategy. The result is an updated insurance position that reflects the client’s current needs and leverages today’s modern products.

True insurance planning is far more nuanced than finding the best underwriting offer or the best price. It involves a perspective beyond a simple needs analysis. It requires understanding how insurance needs change over time and how to best manage a policy or portfolio of policies to deliver the most effective risk management strategies to the client. Today, that means insuring against risks beyond survivor income or estate tax liquidity, with the cost of Long-Term Care as the most significant threat to a successful retirement or a source of estate erosion, reducing the legacy left to loved ones.

That statement comes as no surprise to anyone paying attention to developments on multiple fronts in our industry. That said, simply stacking a new Long-Term Care Insurance policy on top of the client’s other insurance assets may not be the answer, particularly if there are existing insurance policies that may no longer match the needs of the client. More specifically, a personally owned life policy that was a great accumulator of cash but is now under-leveraged and lacks the modern features available from today’s insurance products represents a funding source for an updated insurance strategy. The challenge is how to reposition the policy’s cash values efficiently and for maximum benefit.

Those two outcomes, efficiency and maximum benefit, can seem to be competing intentions at times. An efficient update will minimize costs, both in terms of premium outlay as well as taxation. That typically means a 1035 exchange. That immediately limits product choice to single life products on the same insured. Splitting that exchange to fund multiple policies, perhaps one focused on legacy and another on Long-Term Care, can offer superior benefits, but they remain limited to a single insured. The “Goldilocks” approach, however, still utilizes a 1035 exchange, but follows that with a second transaction. One that funds a similar strategy on the other spouse.

That second transaction, a policy loan, allows for the cash-rich source policy to fund an updated strategy for the second spouse that mirrors the one put in place for the original insured. On the surface, this would seem to create a significant risk in the form of the policy loan that could hamper long-term policy performance. That particular issue is addressed by a planned repayment of the loan via a withdrawal. The end result is two policies, one on each insured, that provide both death benefit intended for their heirs as well as a ready source of funds should the need for Long-Term Care arise.

Consider the following fact pattern:

- A 65-year-old couple

- The husband has permanent life insurance with $400K in surrender value

- The wife has no permanent life insurance

The typical solution would involve a 1035 Exchange to a new policy on the husband’s life that includes Long-Term Care or Chronic Illness Benefits. The client would then fund a separate Long-Term Care strategy for the wife, paid for out of other assets. Alternatively, they could surrender the existing policy, pay any taxes due, and then fund a policy on both husband and wife.

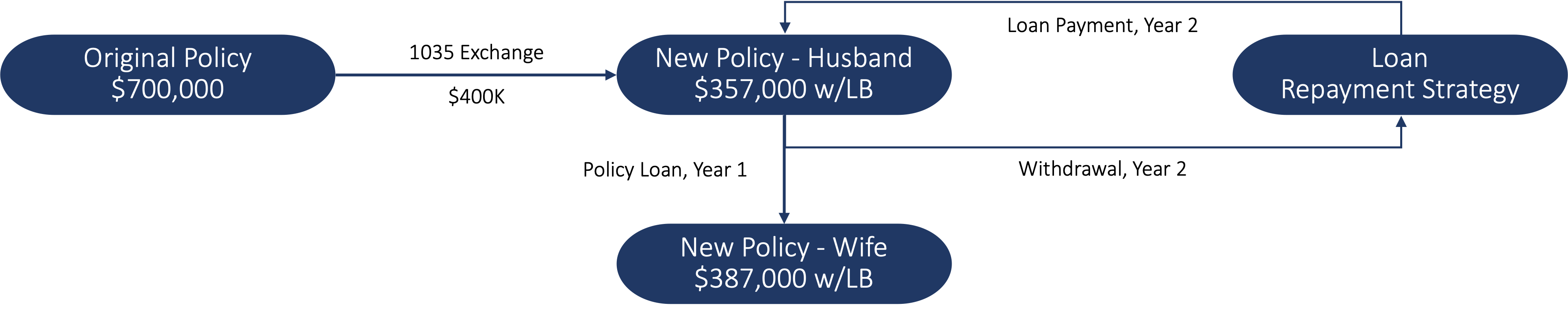

In this case, however, a more effective solution may be available that begins with a 1035 exchange as discussed above, but rather than using other assets to fund a new policy on the wife, the existing cash surrender value on the new policy is used as the source of funds via a policy loan. Figure 1, Funding Two Policies from a Single Exchange, shows the flow of funds, including a critical component: The rapid repayment of the policy loan.

In this case, the loan repayment comes from the husband’s new policy itself. Utilizing the carrier’s ability to take a withdrawal, not to exceed cost basis, that is then used to repay the outstanding loan on the policy, effectively eliminates one of the potential downfalls of the strategy: The long-term health of the policy being compromised by a growing loan balance.

If we revisit our objective of minimizing costs and providing maximum benefits, the approach certainly meets the mark. In summary:

- Existing Coverage:

- Total Life Coverage: $700K

- Total Living Benefits: $0

- Lives Covered: 1

- Account Value: $400K

- Updated Coverage: ¹

- Total Life Coverage: $744K

- Total Living Benefits: $349K

- Lives Covered: 2

- Yr 1 Account Value: $320,631

- Yr 2 Combined Account Value: $291,228

- Additional Outlay: $0

Admittedly, the account values are lower immediately after this transaction is executed. That said, based on current crediting rates, the combined account value exceeds $400K by policy year ten and continues to grow plus the loan balance is zero beginning in year two. In addition, there is no additional out of pocket for the client, zero taxes due, and a significant upgrade to the coverage is achieved by the addition of living benefits. In an environment where most clients are concerned on some level about the economy, finding creative ways to fund planning objectives is critical. This approach is perfectly suited to today’s economy and truly does deliver more value than a single life solution without living benefits.

Notes:

¹ Please see the complete illustrations for additional detail, including illustrative rates and more.

Complete the form below to learn more.

The contents of this document should not be considered as tax or legal advice. Any information or guidance provided is solely for educational or informational purposes and should not be relied upon as a substitute for professional advice. It is always recommended to consult with a licensed financial or legal advisor for specific guidance related to your individual situation.